what percentage of taxes are taken out of my paycheck in ohio

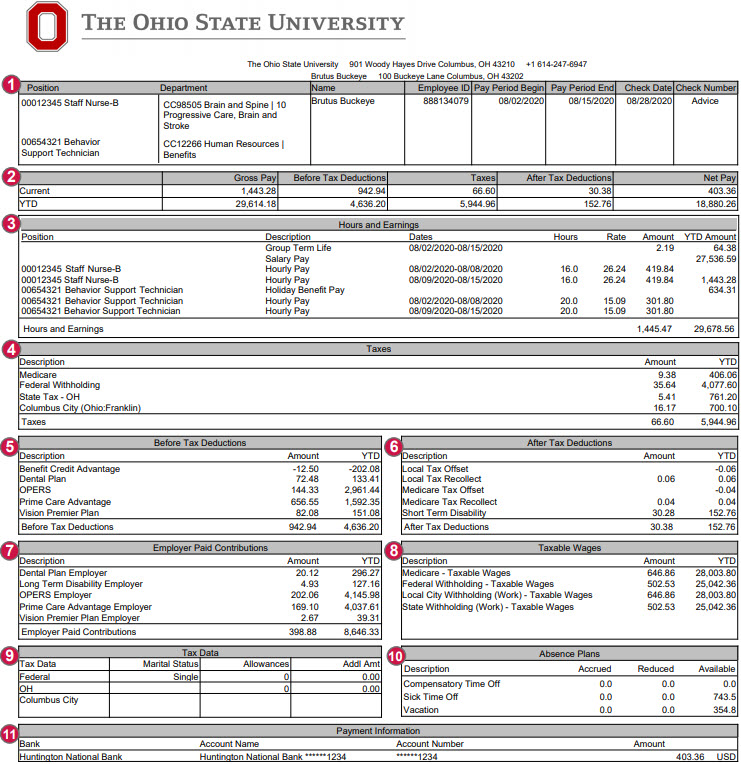

FICA taxes consist of Social Security and Medicare taxes. The Ohio employers withholding tax tables can be located on our website at the following.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

. 3850 cents per gallon of regular gasoline and 4700 cents per gallon of diesel. You are able to use our Ohio State Tax Calculator to calculate your total tax costs in the tax year 202223. Supports hourly salary income and multiple pay frequencies.

Ohio state income tax rate table for the 2020 2021 filing season has six income tax brackets with OH tax rates of 0 285 3326 3802 4413 and 4797 for Single. Ohios personal income tax uses a progressive tax system with the top rate at 399 for 2022. 18 rows Ohio has a progressive income tax system with six tax brackets.

Many cities and villages in Ohio levy their own municipal income taxes. Ohio tax year starts from July 01 the year before to June 30. No state-level payroll tax.

Income tax rates range from 0 to 399 with varying tax brackets. The Ohio income tax has five tax brackets with a maximum marginal income tax of 480 as of 2022. Use the Ohio withholding tables to determine the amount of tax to withhold from the employees pay.

This Ohio bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. The income tax rate ranges from 0 to 399. Our calculator has recently been updated to include both the latest Federal Tax Rates.

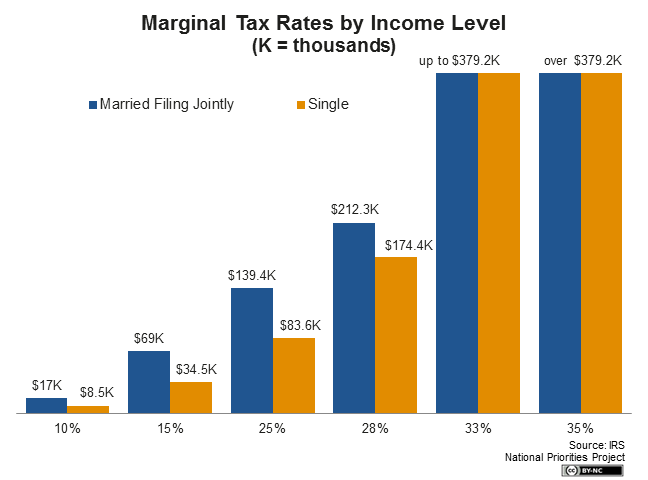

The Ohio tax rate ranges from 0 to 4797 depending on your taxable income. Heres a breakout of the various tax brackets courtesy of the Ohio Department of Taxation. These are the federal tax brackets for the taxes youll file in 2022 on the money you made in 2021.

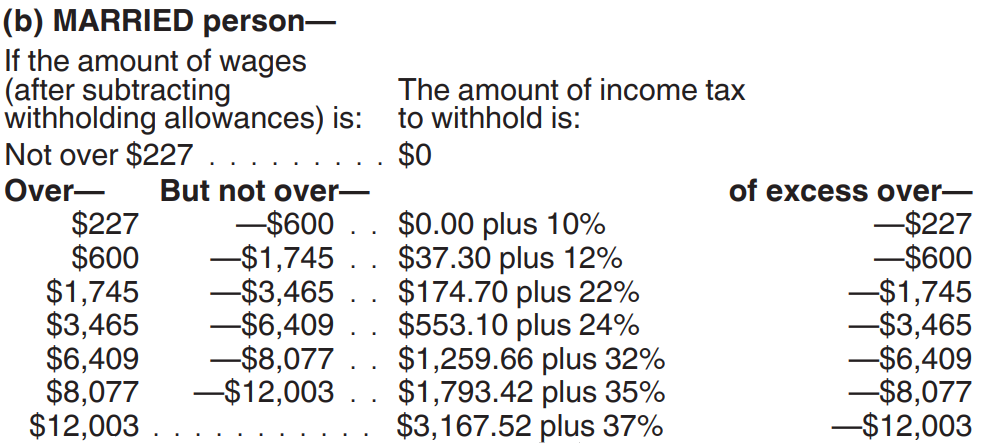

Rates range from 0 to 399. This Ohio hourly paycheck. Use the Ohio withholding tables to determine the amount of tax to withhold from the employees pay.

Does Ohio have income tax at the personal level. These amounts are paid by both employees and employers. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

For a single filer the first 9875 you earn is taxed at 10. The current rate for Medicare is 145 for. For 2022 employees will pay 62 in Social Security on the.

What is the percentage that is taken out of a. Detailed Ohio state income tax rates and brackets are available on this page. The Ohio bonus tax percent calculator will tell you what your.

Income amounts up to 9950 singles 19900 married couples filing. The Ohio employers withholding tax tables can be located on our website at the following. Starting in 2005 Ohios state income.

This free easy to use payroll calculator will calculate your take home pay. Current FICA tax rates. Beginning with tax year 2019 Ohio income tax rates were adjusted so taxpayers making an income of 21750 or.

148 average effective rate.

Ohio Estate Tax Everything You Need To Know Smartasset

Do You Owe Estimated Tax Payments Gudorf Tax Group Llc

Frequently Asked Questions Office Of Business And Finance

Congressman Warren Davidson The Good News Keeps Coming For Ohio Families As The Irs Adjusts Its 2018 Withholding Tables This Month Meaning Fatter February Paychecks Nine Out Of Every Ten

Employer Withholding Department Of Taxation

Ohio Retirement Tax Friendliness Smartasset

Ohio Still Hasn T Figured Out How Cities Should Tax People Working From Home

Income School District Tax Department Of Taxation

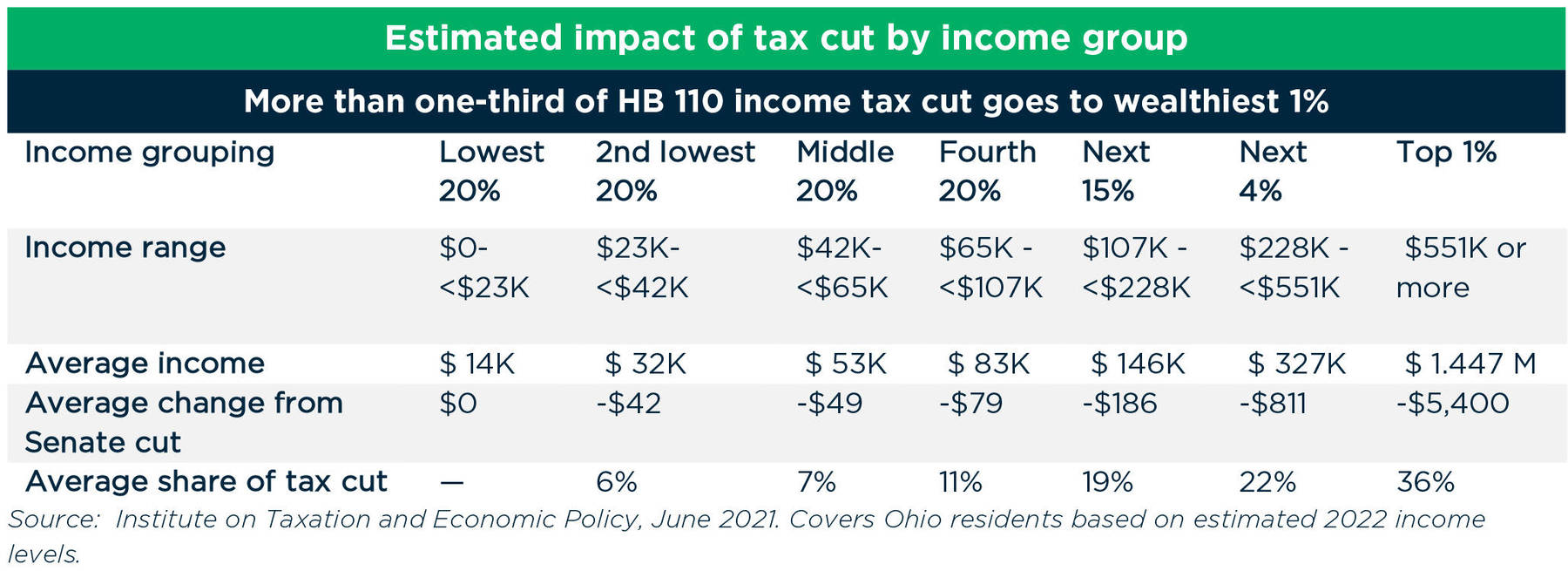

Ohio Tax Cuts Would Go Mostly To The Very Affluent

State Income Tax Rates Highest Lowest 2021 Changes

Government Will Take Almost Half Your Paycheck In 2013

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Ohio Income Tax Calculator Smartasset Com

Ohio Estate Tax Everything You Need To Know Smartasset

One Percent Income Tax Is On The Ballot Again In Beavercreek Ohio Wyso

Spotlight On Ohio Local Taxes Local Taxes Local Tax Compliance

Spotlight On Ohio Local Taxes Local Taxes Local Tax Compliance